UAN Number: 2 different UAN numbers are active, don't worry! You can merge like this..

A working person keeps changing institutions from time to time. In such a situation, many times people doing private jobs have more than one UAN number active at the same time. However, as per the rules, a person should have only one UAN number at a time.

What happens when you have 2 UAN numbers?

Actually, having more than one UAN number active at a time is against the rules. If your two UAN numbers are active then there is no need to worry.

In such a situation, members get the facility to transfer EPF account funds. In the case of two UAN numbers, you can deactivate one of the numbers.

To deactivate the old UAN number, EPF member gets two methods offline and online-

Offline method

If you want to deactivate UAN, you will have to inform the existing institute where you are working.

You can give information to EPFO by sending an email to uanepf@epfindia.gov.in.

All information regarding deactivating UAN will have to be given in this mail.

Upon sending the mail, the verification process starts from EPFO, after which the old UAN number gets deactivated.

However, the work does not end here, after this, you will have to apply for a PF transfer.

After this, your old PF account funds will be transferred to the new PF account.

Online method

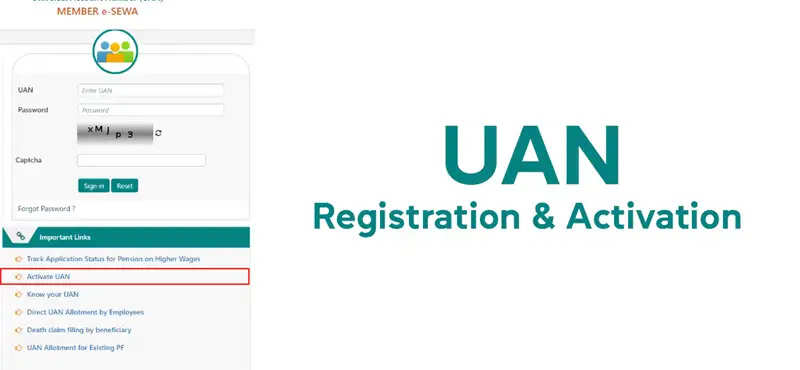

First of all, one has to apply for the transfer of old PF funds to the latest account through One Member One EPF Account at https://www.epfindia.gov.in/.

Now you have to log in to your One Member One EPF account with the new UAN and password.

In online services, you have to click on Request for Transfer of Account.

Now you have to apply for a transfer to the linked account.

Now EPFO will verify your details.

After verification, the old UAN gets deactivated.

Information about this is received through SMS on the mobile number registered with EPFO.

After this, in the further process, you can get the funds from your PF account transferred to the new i.e. existing PF account.

PC Social media

(1).png)