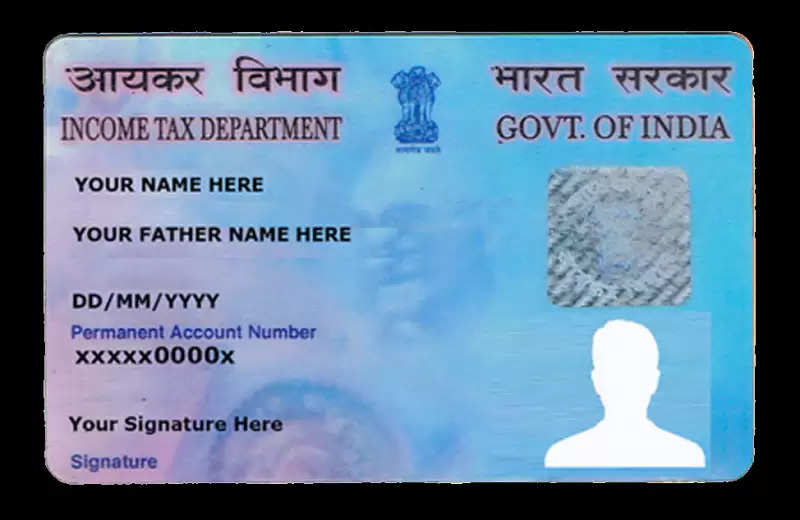

Pan Card: Pan Card has become 10 years old so know this update..

PAN Card News: The PAN card is known as an important document in the country. At the same time, a PAN card is required to file an income tax return and without a PAN card, an income tax return cannot be filed. Apart from this, a PAN card is also required for big financial transactions. In such a situation, if your PAN card becomes old then one important thing should be kept in mind.

PAN card-

Actually, people have had PAN cards for years. If it has been 10, 20, or 30 years since you had the PAN card, the PAN card may become slightly blurred and the signatures on it may also become blurred which are not clearly visible. In such a situation, even when copies of PAN cards are issued, people are not able to get the correct print. In such a situation, a question arises in the minds of people whether it is legally necessary or mandatory to replace the old PAN card with a new one. Let us know about it...

Permanent Account Number-

Tax and legal experts told what the rules say regarding old PAN cards. Experts said it is not mandatory to replace the old PAN card as the Permanent Account Number (PAN) remains valid throughout the lifetime of the taxpayer unless it is canceled or surrendered.

It is also used for identification-

There is no special order to replace old and worn-out PAN cards. Although a PAN card is primarily for tax purposes it is also often used as a proof of identity. In such a situation, to avoid any inconvenience, it is important that the information written on the PAN card is clear so that your identity can be verified.

You can request for a new copy-

In such a situation, you can get a copy of your electronic PAN (ePAN) from the NSDL PAN portal. A new physical copy of a PAN card can also be requested on the same portal by paying a fee. At the same time, it is not mandatory to change PAN cards due to wear and tear because PAN cards are valid for life. If people wish, they can apply for a duplicate PAN card by submitting an online or physical application form by following the official guidelines of the Income Tax Department.

PC Social media

(1).png)