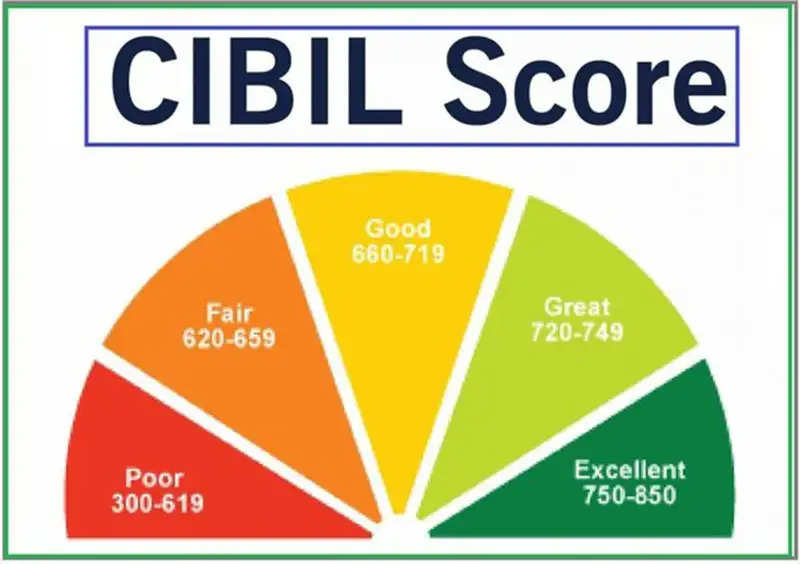

CIBIL Score: Who decides the CIBIL score, know on what basis it is decided..

Whenever there is talk of taking a loan, the first thing that is mentioned is the credit score. By looking at your credit score, banks decide whether they should give you a loan or not. Besides, this also affects the interest rate of the loan. That means, if your credit score is good then you get the loan easily and with better interest rates. But if the score is not very good then it is difficult to get the loan and if it is available then high interest is charged on it. But has this question ever come to your mind on what basis is the credit score prepared and who prepares it? Know about it here-

Know who prepares your credit report

All credit bureaus issue your credit report. Among these, credit information companies like TransUnion CIBIL, Equifax, Experian, and CRIF Highmark are considered prominent. These companies are licensed to collect financial records of people, maintain them, and generate credit reports/credit scores based on this data. These credit bureaus evaluate the customer's data deposited with banks and other finance institutions such as outstanding loan amounts, repayment records, applications for new loans/credit cards, and other credit-related information, etc., and prepare the CIBIL score based on that. We do.

These factors are especially considered while preparing the CIBIL score.

Your credit history starts building from the moment you take a loan or a credit card for the first time. While preparing a CIBIL score, your credit history is first considered. Only through this, we can know how old is your credit history and how is your repayment record. This credit history also affects your CIBIL score.

While preparing the CIBIL score, your CUR i.e. Credit Utilization Ratio is also considered. CUR means what percentage of the credit limit you have is used by you. If you are a credit card user, then use only 30 percent of your card limit. Avoid making very big purchases through credit cards. A high credit utilization ratio shows that your dependence on credit cards is very high. This affects your CIBIL score.

Your credit mix is determined by how many unsecured loans and how many secured loans you have taken earlier. Your credit mix should be balanced. If you have taken unsecured loans like personal loans, credit cards etc. many times in the past, then it shows that you are short of funds and your dependence on credit is very high. At the same time, if you have been taking both secured and unsecured loans when needed, and have paid all of them on time, then it shows that you are capable of managing all types of loans. In such a situation your credit mix remains balanced.

While preparing the CIBIL score, some other things are also considered like whether you have done any loan settlement before, you are the guarantor of someone's loan and it is not being paid, then this messes up your credit record and has a direct impact on your Affects CIBIL score.

PC Social media

(1).png)