CIBIL Score Tips: You can take a loan even on a deteriorated CIBIL score, know the method..

If your CIBIL score or credit score is not good and you are worried about taking a loan. You can easily avail a personal loan even with a bad credit score. Let us tell you that for a loan it is very important to improve your CIBIL score or credit score. If your credit score is good then there is no problem in getting a loan. Credit scores help banks or financial institutions evaluate the creditworthiness of borrowers.

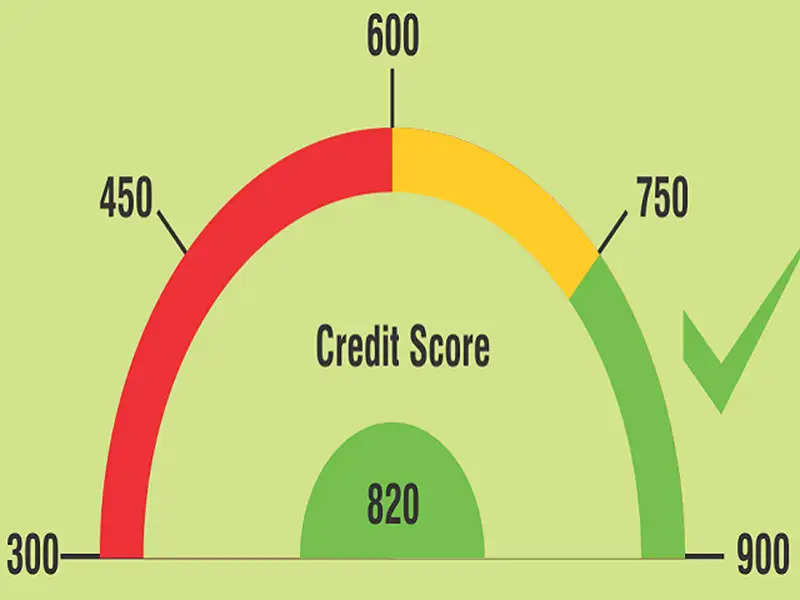

You must be aware that a personal loan is not available if you have a bad credit score. However, this is not correct. There are many solutions, using which you can easily take a personal loan even with a bad credit score. Let us tell you that credit score ranges between 300 to 900. A credit score above 750 is considered better. A CIBIL score between 550 and 750 is considered good, while a CIBIL score below 550 is considered very bad. Therefore people of this level are not able to get loans.

Take special care of these things

In case of a poor credit score, the loan can be obtained with the help of a co-signer or guarantor. If you apply with the help of a co-signer, the bank will consider your credit score. Similarly, having a guarantor will increase the bank's confidence that you will not default on loan repayment.

In case of a bad credit score, a personal loan can also be taken by mortgaging the property (Personal loan against property mortgage). It is just like a guarantor. In this, instead of the guarantor, you have to keep some assets with the bank, which gets attached to the loan. If the loan is not repaid, the bank can sell the mortgaged asset.

Having a bad credit score makes it difficult to get any type of loan approved. However, if you ask for a personal loan of a small amount then you can get the loan. This reduces the risk of the lending institution as the loan amount reduces.

Many times, errors and mistakes in the credit report can become the reason for a bad credit score, which affects the chances of getting a loan. Check your credit report online at least once a year. If there is any kind of mistake, report it.

PC Social media

(1).png)