Cibil Score Tips: Don't worry if Cibil score gets spoiled, adopt these methods..

Today, a person's credit score has become very important. Your credit score determines how much loan you should get and what the interest rate will be. Apart from this, your credit history also plays a big role in the approval of your loan application.

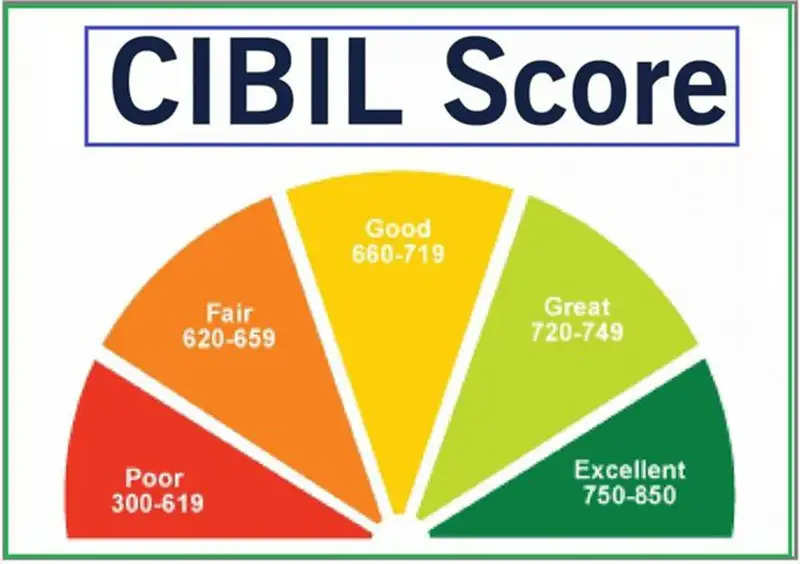

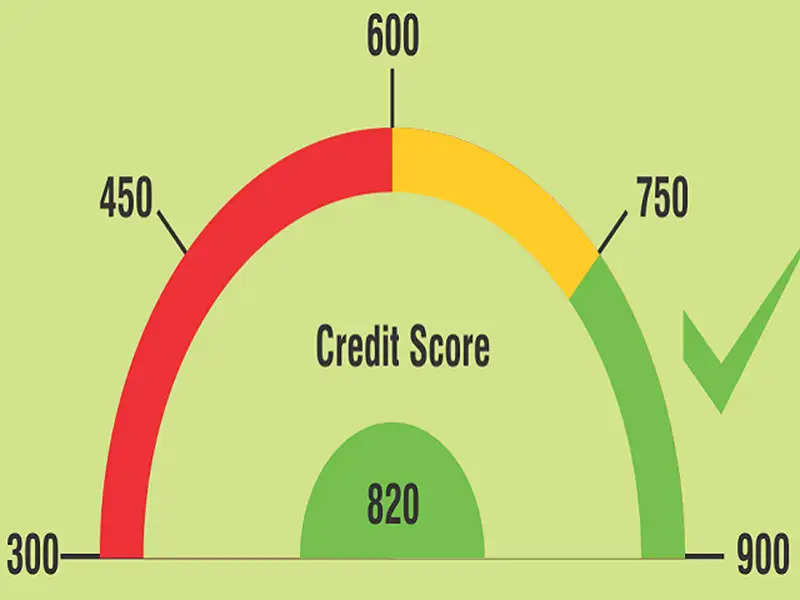

According to credit score organization CIBIL, the credit score range can be between 300-900 and people whose score is 750 or more can get a loan quickly and easily. Credit score has a direct impact on your financial health.

A good credit score means that you have less risk of losing money. A bad credit score means that there may be doubts about repaying your loan. Therefore, know the ways by which you can keep your credit score excellent.

1. Don't forget the last date

Do not forget the last date of the monthly installment of the house or car. Also, keep the last date of payment of your credit card bill safe. Delays in both of these will have an adverse effect on your credit score. If you have been lazy in such matters before, then you will have to show some agility in this.

After 6 to 8 months of improvement, your credit score will start improving. Radhika Binani, chief product officer, of Paisa Bazaar.com, said, "Unlike Western countries, in India, mobile and other utility bills are not included in the calculation of credit score."

2. Better credit utilization ratio

The credit utilization ratio means how much loan you have taken out of the limit set for yourself. For example, if your loan limit is Rs 1 lakh and you have taken a loan of Rs 40,000, then your credit utilization ratio will be 40 percent.

The limits of all your credit cards are also included in this calculation. Suppose you have 3 credit cards whose spending limits are Rs 50,000, Rs 75,000, and Rs 1 lakh and you have spent a total of Rs 72,000 from all three. So your credit utilization ratio will be 32 percent. (Rs 72,000/Rs 2.25 lakh)

Binani says in this regard that companies give priority to those customers whose credit score is less than 40 percent. That is, the lower this ratio is, the easier it will be for you to take a loan.

3. EMI-to-income ratio

It is calculated on the basis of your income loans and credit cards. The maximum EMI-to-income limit is considered to be up to 50 percent. This means that half of your money is for your living expenses.

Explaining it simply, Hrishikesh Mehta of TransUnion, CIBIL said that if your monthly income is Rs 50,000 and your current EMI is Rs 10,000, then your EMI-to-income ratio will be 20 percent.

If you apply for a loan again after this, the lender will assume that you can pay the additional EMI of only Rs 15,000, as the EMI of Rs 10,000 is already on. In this ratio, only your in-hand salary is counted.

4. Do not increase the card limit frequently

Many people feel that their expenses have become excessive due to excessive expenditure in a month or two. In such a situation, increase your credit card limit. Instead, you should control your spending because, in the end, you have to pay the bill, which will affect your credit score.

5. Finish the loan, not settlement

Your credit history also mentions whether you have repaid or settled old loans. If you have settled, it means the lender's risk increases. Similarly, if you have proof of repaying the loan on time, then the loan becomes easy.

6. There should not be any mistake in the credit report.

Many times it happens that some small mistake occurs in the credit report, which we are unable to notice. However, later one has to suffer the consequences in the form of a weak credit score. Radhik Binani advised you to check your credit report every month because you are responsible for your credit score.

7. Read your credit report before applying for a loan

Credit score also determines your credit risk. If your score is low then the bank may charge you more interest or may even cancel your loan application. Binani said that before applying for a loan, definitely read your report and if possible, improve it.

PC Social media

(1).png)