Bank Cheque Rule: When to sign on the back of the cheque, know the rules..

Nowadays, all the work related to banking (banking rules for cheques), from withdrawal of money to deposit, is being done online. But, this does not mean that the importance of the chequebook has diminished. You can easily give money to anyone through a cheque. You must have often seen that at the time of a transaction through a cheque, the back of the check is always signed. Have you ever wondered why this is done?

These things should be kept in mind while signing the back of a cheque-

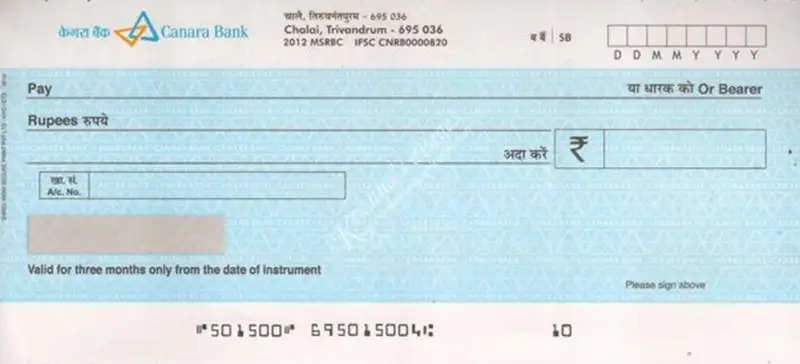

A check (signed on cheque) is a written guarantee of a financial institution or individual withdrawing cash. It can be understood that it is usually a written order to a bank to pay a fixed amount from one account to another. Check is considered by the bank as a safe, secure, and convenient way of conducting transactions between two parties.

Signing on or behind a check has a special meaning in the language of the bank. Not all types of checks are signed on the back. Only bearer checks are signed on the reverse side. A bearer's check is called that type of check which is deposited in the bank and does not have any person's name on it. With the help of that cheque, anyone can withdraw cash from the bank. The bank treats the bearer's check as a transaction issued with consent. According to the rules, the bank is not responsible for fraud caused by such cheques.

Be sure to know these things related to cheques-

The check can be issued for a current or savings account.

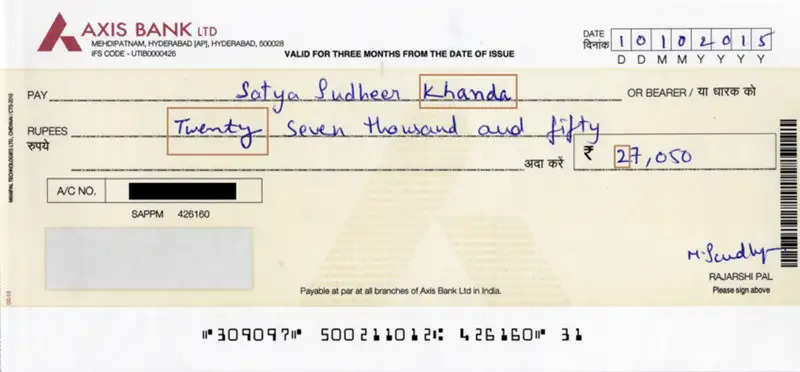

Only the payee named on the check can encash it.

An undated check is considered invalid.

A bank check is valid for three months from the date of issue.

There is a 9-digit MICR code at the bottom of the check which facilitates the check clearance process.

The check amount should be written in both words and figures.

The drawer of the check must sign the check without overwriting.

The name of the payee should be written correctly on the cheque.

Know which signatures are required on the back of the cheque.

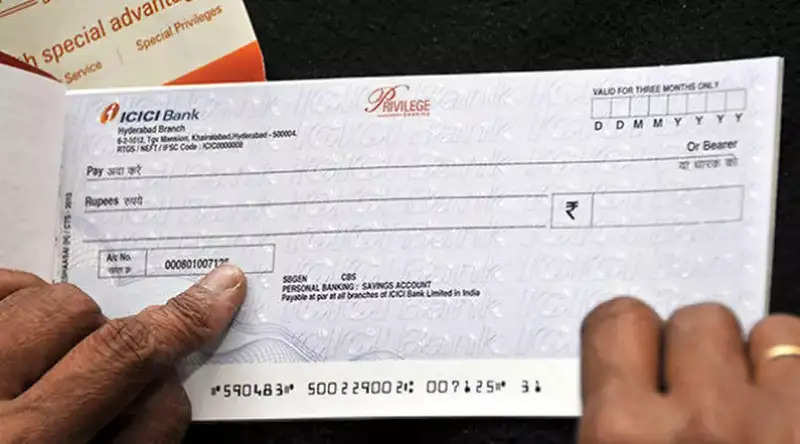

Most people are not aware of when the signature is put on the back of the cheque. Please note that not all types of checks are signed on the back. A signature on the reverse is required only for bearers' cheques. Whereas there is no need to sign on the back of the order cheque. A bearer's check is one which you have to deposit in the bank. It does not contain any person's name, so it is necessary to sign on the back of it.

When is there no need to sign a cheque?

As we mentioned above, signatures are not required on the back of orders or payee cheques. Apart from this, a signature is also not required on a bearer check when a person has gone to withdraw money from his own account through a cheque. A signature is required only when a third party comes to withdraw the bearer's check at someone else's request.

That's why we get bearers to sign the back of the cheque.

If you cut a bearer check and it gets stolen by mistake, it can cause huge losses to you. There is no person's name on this cheque, so the bank makes you sign on the back of it. The bank does not accept bearer checks without a signature on the back. This ensures that the transaction done through this check is done with your consent and the bank will not be responsible for any mistake in it.

These are the rules regarding the signature on the back of the cheque-

Many times, to verify the signature on the cheque, banks also require signatures on the back of the cheque. But this is necessary only when a third person approaches the bank with the bearer's cheque. If you use a bearer check to withdraw money from your account, there is no need to sign on the back of the cheque. Apart from this, the back side of the payee check and order check is also not signed. At the same time, if the check amount is more than fifty thousand rupees, the bank also takes address proof.

PC Social media

(1).png)